Contrary to all expectations, stock markets perform clearly positive in 2023

As in previous years, the 2023 stock market year was characterized by numerous challenges: Geopolitical issues, including the two-year-long armed conflict in Ukraine and the uncertain situation in the Middle East, influenced the stock markets, as did weak economic growth. High inflation and central banks’ tight interest rate policies for the most part also had a negative impact. The latter continued to work against high inflation in 2023 – albeit with a lower increase compared to the previous year. Overall, the global capital markets were strongly driven by the measures and statements of central banks in the reporting year. The difficulties of some US regional banks and the insolvency of the Swiss bank Crédit Suisse as well as weak economic development in China throughout the year – particularly in the real estate sector – further depressed market sentiment. In the USA, weeks of strikes in the American automotive industry also had an impact on economic development. In contrast, the end of the coronavirus pandemic declared by the World Health Organization in spring 2023 had a supporting effect. This also led to a noticeable relaxation in global supply chains. In addition, companies were able to successfully reduce some of their high order backlogs in the first few months of 2023, meaning that companies in Germany in particular were able to reduce their order backlogs by the end of the first half of 2023 and surprisingly deliver better than expected results.

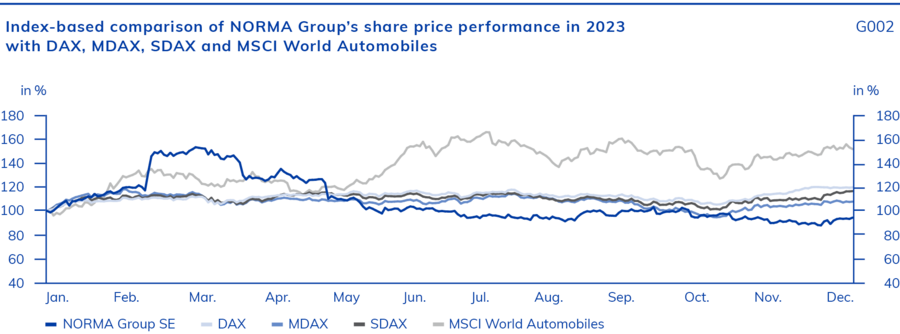

Despite the many challenges that remain, the capital markets generally performed well in the 2023 reporting year, reaching new all-time highs in some cases at the end of 2023. On December 13, 2023, the Dow Jones Index reached the 37,000 point mark for the first time. Overall, the index ended 2023 with an increase of 13.7%. The broader S&P 500 Index even rose by 24.2% in 2023. The MSCI World Automobiles Index, which is regarded as a trend indicator for the global automotive market, showed an even clearer recovery in percentage terms. It closed the stock market year 2023 at 296 points, 53.2% above the previous year-end level. In 2022, the index had lost more than half of its value due to the uncertain economic situation.

The German stock market also defied the challenging environment and performed very positively after the negative conditions of the previous year. Starting from a year-end level of 13,924 points in 2022, the German benchmark index DAX rose over the course of 2023 and also reached a historic high of 17,003 points on December 11, 2023. The DAX closed the last trading day of 2023 at 16,752 points, which corresponds to an increase of 20.3% compared to the closing level in 2022. The SDAX, to which NORMA Group shares belong, showed a similarly dynamic performance. The index closed the year at 13,960 points, 17.1% above the 2022 closing price. By contrast, growth in the MDAX was weaker: It rose by 8.0% over the year and stood at 27,137 points on the last trading day of 2023.

Legend

These contents are part of the Non-financial Group Report and were subject to a separate limited assurance examination.