Stakeholders & Materiality

Close exchange with stakeholders

NORMA Group sees itself as a transparent and open company. The Company specifically seeks exchange with its internal and external stakeholders as well as experts. This enables the Company to effectively implement the continuous improvement process, which is applied throughout the Group, for CR issues as well. NORMA Group’s most important stakeholders and experts include its employees, customers, shareholders, and financial market players, as well as the media, politics, and non-profit organizations. The Company considers it part of its responsible corporate governance to incorporate the interests of stakeholders and the impact of its own business activities on stakeholders into its key decisions. Particularly in the strategic direction of the Company as well as in identifying material topics, NORMA Group values an open approach to stakeholder expectations.

Materiality analysis defines scope of CR activities

In 2020, NORMA Group carried out its last materiality analysis, in which it defined the most important social, environmental, and economic sustainability issues. The methodology was based on the requirements of the German Commercial Code (HGB) and the standards of the Global Reporting Initiative (GRI 2016): First, a comprehensive list of CR sub-topics was put together, based on requests from external stakeholder groups and on the GRI standards and the requirements of the German Commercial Code (HGB). The individual sub-topics were aggregated, and a total of 23 topics were defined, which were divided into the three areas of action “Environment,” “Social” and “Governance.”

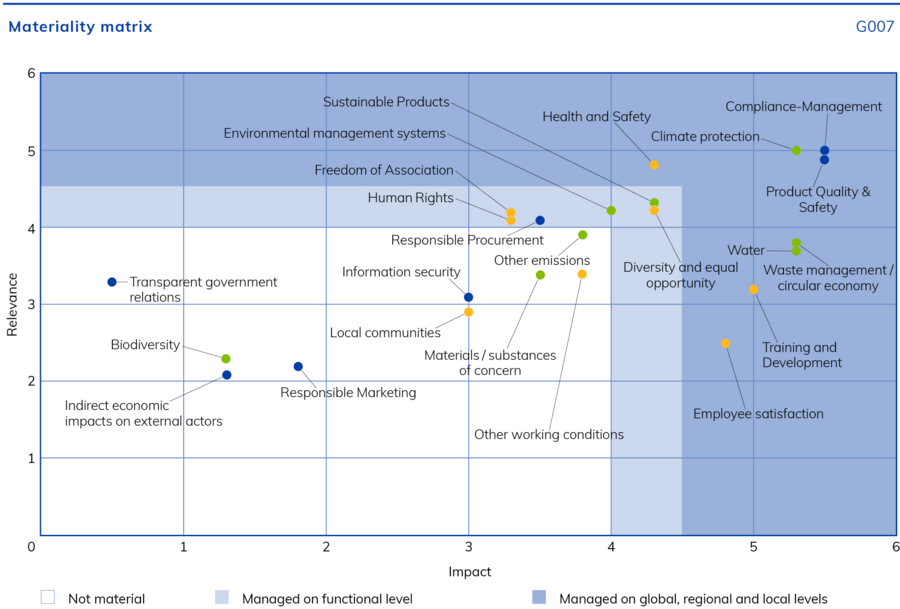

For each of the 23 defined sustainability topics, NORMA Group evaluated the relevance and impact. The relevance assessment was based on a survey of NORMA Group employees and the weighting of external customer and financial market ratings as well as an analysis of the assessment by the media and existing and future legislation (relevance axis). The impact analysis assessed both the extent to which NORMA Group’s business activities influence the various topics and what risks could arise for the Group from these topics (impact risk axis). The latter was based on what are known as gross risks, i.e. those risks with which the NORMA Group is confronted if no suitable countermeasures are implemented. The assessment was deducted on a scale of 1 (irrelevant/no impact) to 6 (very relevant/major impact) and then prioritized ( GRAPHIC G007: ‘MATERIALITY MATRIX’). This was divided into topics that are a) managed globally, regionally and locally with measurable targets (right outer area), b) topics that are managed at the functional level through concrete measures (middle area) and c) those that are not considered material. The results can be broken down according to which topics are material according to the German Commercial Code and the GRI standard (climate protection, water, waste management/circular economy, employee satisfaction, training and development, compliance management, product quality and safety) as well as topics that were also classified as material according to the GRI standard (environmental management system, sustainable products, occupational health and safety, diversity and equal opportunities, human rights, responsible

procurement, freedom of association). The results were validated internally with the top management of all regions and subsequently confirmed by NORMA Group’s Management Board.

In 2023, the materiality analysis was again validated with the Management Board, the top management of the regions and the specialist departments. There were no changes.

In preparation for the EU Corporate Sustainability Reporting Directive (CSRD), NORMA Group has conducted a double materiality assessment, which will form the basis for reporting in accordance with CSRD from 2024. The topics identified as material will be reported in accordance with European Sustainability Reporting Standards (ESRS) from the next fiscal year.

1_The CO2 emissions for the target value are reported in accordance with the GHG Protocol (market-based, Scope 1 and Scope 2). Scope 1 only includes emissions from natural gas and liquefied natural gas and Scope 2 emissions from purchased electricity and district heating. When recording emissions, only emissions relating to the production sites are taken into account. Since January 2022, NORMA Group has purchased electricity from renewable energy sources at all production sites. NORMA Group purchases "Energy Attribute Certificates" for this purpose. These are also included in the target value.

2_Total amount of water withdrawn from the production sites.

3_Metal waste: Total weight of all metals generated by NORMA Group's operations that must be disposed of (excluding hazardous metals, including defective supplier parts that must be scrapped). Plastic waste: Total weight of plastics produced (excluding packaging material).

4_Calculation of the accident rate and number of medical treatments is based on the total workforce including temporary workers.

5_Personnel development activities in which employees acquire or develop skills.

6_Employees who leave the company voluntarily.

7_Number of confirmed defective parts divided by the number of parts delivered and multiplied by one million.

8_Total number of accepted customer complaints in the calendar month

Legend

These contents are part of the Non-financial Group Report and were subject to a separate limited assurance examination.