Purchasing and supplier management

The procurement costs of materials, goods and services have a significant impact on NORMA Group’s earnings position. By managing all procurement activities efficiently and selecting the proper suppliers, Purchasing can make a significant contribution to the success of the Group. The main task here is to optimize the services purchased and minimize costs by taking Group-wide economies of scale into account.

Global purchasing organization

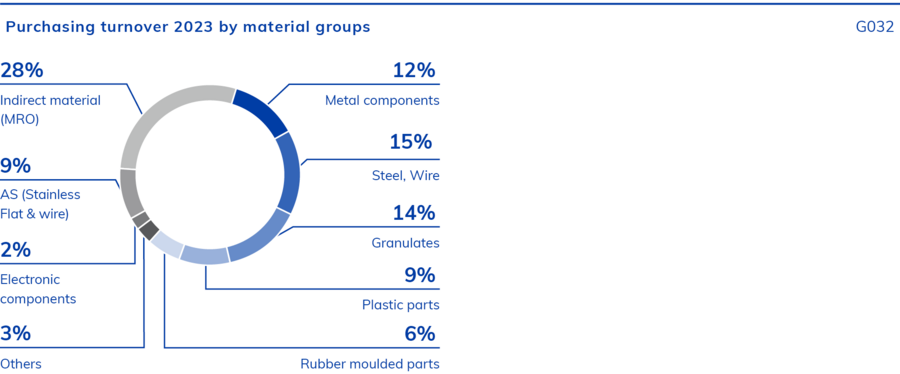

NORMA Group's purchasing activities are divided into four superordinate product groups:

•Steel and metal components (FASTEN)

•Technical granulates, plastic and rubber products (FLUID)

•Standard plastics, components and commodities (WATER)

•Capital goods, non-production materials and services (indirect goods and services)

With its existing expertise in the product groups, the purchasing organization supports the established strategic business units Water Management, Industry Applications and Mobility & New Energy. GROWTH AND EFFICIENCY PROGRAM "STEP UP"

In addition to this central structure, there is a subdivision into the regional segments EMEA (Europe, Middle East and Africa), Asia Pacific (East Asia, Southeast Asia, Australia and Oceania) and the Americas. This organizational structure enables centralized control by the respective experts of the product groups and the integration of the knowledge of the regional or local purchasing teams concerning specific local market conditions. NORMA Group thus ensures professional purchasing management and the achievement of competitive prices for goods and services. Digital procurement solutions support the global organization in its work and thereby enable efficient reporting.

Development of material prices

In fiscal year 2023, the cost of materials amounted to EUR 549.6 (2022: EUR 597.0 million), which corresponds to a share of 45.0% (2022: 48.0%) of sales. The cost of materials ratio was therefore once again lower than in the previous year EARNINGS POSITION as the inflation rate in many purchasing areas was lower than in previous years. The purchasing volume, which is used for internal management purposes and adjusted for currency effects, amounted to EUR 537.1 million (2022:EUR 538.9 million). Of this amount, EUR 377.9 million, or 71%, was attributable to sales of production materials.

Steel and metal components

Given purchasing and supplier management, there were already signs of the tense supply situation from the beginning of 2022 easing in the second half of 2022. This trend continued in the reporting year 2023. A general improvement in the availability of materials subsequently also led to an easing of procurement prices, particularly in the EMEA and Asia-Pacific regions. In addition, the normalization of energy prices in Europe also resulted in an easing of inflation rates.

In the fiscal year 2023, the supply of raw materials (steel and wire) and metal components to the global production sites was very good, bar a few exceptions. In addition, delivery times shortened immensely during the year. This development is attributable to lower capacity utilization at the supply plants, accompanied by a decline in demand in many industry segments. Geopolitical crises – including the war in Ukraine in particular – had no significant impact on the availability of materials in the metals sector in 2023.

In the stainless steel product group, which is important for NORMA Group, significant price reductions in contract prices (basic purchase price for stainless steel without alloy surcharges) were achieved in the annual price negotiations for fiscal year 2023 in the EMEA region. In contrast, price negotiations in the Americas region proved to be much more difficult. On the one hand, protectionist instruments to isolate the market continued to have an effect, meaning that no material price changes were initially achieved despite intensive efforts. On the other hand, the high level of base prices from fiscal year 2022 continued to persist. The situation eased slightly in the second half of 2023 on the back of an important supplier contract expiring and a discount being agreed in renegotiations. In the Asia-Pacific region, and particularly in China, lower purchase prices for stainless steel products were

achieved in negotiations – similar to the EMEA region. This was helped by the fact that the alloy surcharges are included in the price agreements there and are not charged additionally downstream in the attachment procedure.

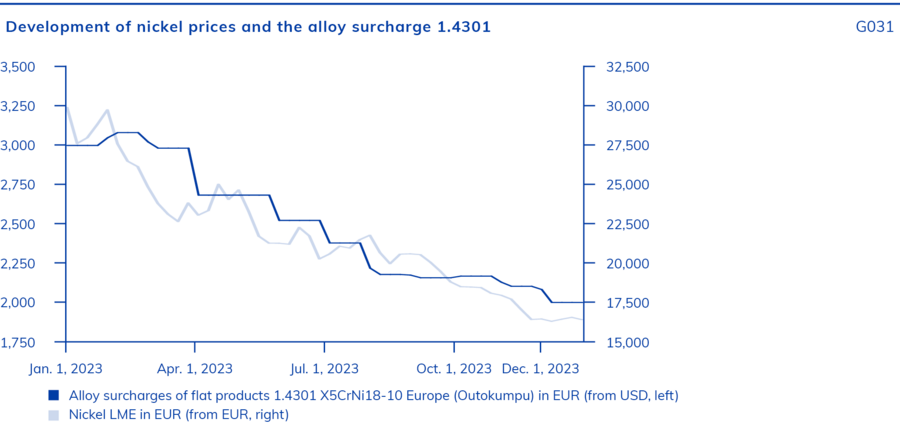

In the EMEA and Americas region, prices of the newly agreed monthly alloy surcharges (price components include nickel, scrap and ferrochrome prices) developed inconsistently on closer inspection. Austenitic materials (the main cost driver is the alloying element nickel) initially increased in the first quarter of 2023 and then, from the second quarter 2023 on, followed the falling price trend for nickel – as illustrated by the example of the material 1.4301 in Germany ( CHART G031: DEVELOPMENT OF NICKEL PRICES AND THE ALLOY SURCHARGE). Ferritic materials tended to follow the fluctuating prices of the main cost drivers ferrochrome and scrap. Overall, it should be noted that following the sharp increase in 2022, alloy surcharges remained at a high level in the current reporting year and were well above the price level of recent years.

With regard to the metal components used, NORMA Group was only able to reduce the purchase prices significantly in fiscal year 2023 in a few cases.

In the case of expiring contracts, slight increases often had to be accepted despite intensive negotiations due to the general market and economic situation. High energy and increased wage costs as well as higher packaging and transportation costs were the reasons for the price increases in the EMEA and Americas regions.

In the product group of surface-finished stainless steel and cold-rolled strip, purchase prices remained elevated in the first half of 2023. The high energy costs and limited availability due to production cuts supported the producers' pricing policy. In the case of standard materials, prices could be reduced slightly in the second half of 2023, in line with a decline in demand in many industrial segments. For the year as a whole, procurement prices in this segment fell slightly compared to the previous year.

Technical granulates, plastic and rubber products

In the product group of technical granules, plastic and rubber products, the first half of the fiscal year 2023 was sustainably impacted by high gas and energy prices caused by the Ukraine conflict. The upward price trend already began in the second and third quarter of 2022 and continued to be on a high level in the first two quarters of the fiscal year 2023. The massive increase mainly affected the EMEA region, but also the Americas region to a lesser extent. The Asia-Pacific region was less affected by the increase, largely due to the subdued economic development in China.

This situation was exacerbated by a shortfall in volumes that had already started in the previous year. This was largely due to a lack of capacity for high-performance plastics and a shortage of raw materials. This development ultimately led to some suppliers declaring force majeure.

Both the challenging price situation and the availability of quantities of technical granules improved significantly in the second half of 2023. Falling prices for gas and energy, a significant increase in capacity at manufacturers and the possibility of accessing new producers led to a significant easing of the situation on the market. In line with slowing demand in the fourth quarter of 2023, prices began to ease noticeably. This enabled NORMA Group to achieve price reductions in some cases.

High purchasing costs for granulates, combined with the sharp rise in energy and gas prices, also led to a significant price increase for plastic components, which continued throughout the entire fiscal year 2023.

The rubber products product group was negatively impacted by the Ukraine crisis throughout the fiscal year 2023. For example, the conflict led to a massive shortage of volumes and consequently to high price pressure, as important primary raw materials for rubber are largely produced in the two countries involved in the conflict.

NORMA Group was able to address this situation through targeted supplier management, which lead to a sufficient volume supply, albeit at significantly higher input costs. In the fourth quarter of 2023, there were signs of prices for certain commodities falling again for the first time, although prices remained at a significantly higher level than before the Ukraine conflict. The upward price trend for some raw materials remains unbroken, meaning that there will be no significant improvement in the first half of 2024 in the rubber commodity product group.

Standard plastics, components and commodities

Following the unexpected events of recent years, recovery in the global economy varied from region to region in the reporting year 2023. The Russian attack on Ukraine led to further disruptions in the supply and logistics chains, which resulted in an initial rise in commodity prices. The subsequent decline in global demand as well as the build-up of inventories in the second half of 2022 led to a weakening of raw material prices as well as the prices for natural gas and crude oil, which influence the cost of plastic raw materials. This trend continued in 2023, meaning that the situation for standard plastics stabilized significantly.

The market for standard plastics, components and commodities already showed signs of stabilization in 2022 and continued this trend in 2023. Despite the challenges posed by various existing crises and conflicts – including the ongoing war in Ukraine, geopolitical rivalry between the USA and China, reduced crude oil production volumes by OPEC – negotiations and adjustments in the supply chains have enabled a return to predictable price structures.

NORMA Group, for example, successfully overcame these challenges and was able to negotiate purchase prices for synthetic resins that in most cases were back to pre-pandemic levels. The expanded supply base also enabled NORMA Group to validate new raw materials and suppliers, which strengthened its market position.

However, there are still regional price differences. Domestic prices for PVC in the USA are still around 15% higher than before 2020.

High energy prices in 2023

Following significant changes on the electricity and gas markets in 2022, the fiscal year 2023 was marked by less volatility and variability in gas and electricity prices. Nevertheless, the market remained unstable and susceptible to even minor signals on the geopolitical map of the world. This was particularly the case in Europe. Electricity and gas prices there shot up substantially in 2022. Although the subsequent price declines at the beginning of 2023 were significant, the adverse effects of the previous record price levels were very pronounced in some of NORMA Group's European plants. This affected those plants for which electricity and gas supply contracts had to be renegotiated by the end of 2022. This led to price increases, some of which exceeded the 100% mark. In order to mitigate the negative effects, NORMA Group explored the possibilities of state subsidies in all European countries. Subsidies were applied for where NORMA Group met the government requirements, with the aim of alleviating some of the financial burden of the increased prices.

Supplier management and structure

The purchasing organization continuously monitors the performance of suppliers. Annual evaluations of suppliers are a key instrument in this respect. This involves the use of globally uniform criteria from the areas of quality, logistics, sustainability and commercial aspects. The relevant departments are involved in the assessments at the local level. The evaluation process is mapped using e-procurement software. Besides the annual supplier performance evaluation, supplier risks are monitored continuously using automated risk management software. This helps the purchasing organization to maintain a constant overview of resilience in the supply chain and to initiate the necessary measures early on. SUSTAINABILITY IN PURCHASING

The focus of NORMA Group’s supplier selection is a balance of supplier consolidation to reduce complexity and avoiding strong dependencies. This balance is continuously optimized by the purchasing department. The current supplier base is as follows: In fiscal year 2023, 34.6% of the purchasing volume was attributable to NORMA Group's top 10 suppliers. The top 50 suppliers accounted for around 65.2% (EUR 247.2 million) of the total purchasing volume of production material, amounting to EUR 377.9 million.

Legend

These contents are part of the Non-financial Group Report and were subject to a separate limited assurance examination.